All-in-one-marketing software for Tax Pros

Training Materials

Internal Forms

Bank Compliance Training

Announcements

AI-Powered Tax Automation and Its Seamless Integration with Tax Pro 360

Experience Tax Excellence. Embrace AI-Powered Automation with Tax Pro 360 Today!

Meta Description: AI turbocharges tax prep with Tax Pro 360. Efficiency, accuracy, and client satisfaction in one seamless package!

CTA: Experience Tax Excellence. Embrace AI-Powered Automation with Tax Pro 360 Today!

In an era driven by digital transformation, the marriage of Artificial Intelligence (AI) and innovative software solutions like Tax Pro 360 has ushered in a new era of tax preparation.

Gone are the days of sifting through mountains of paperwork and grappling with complex tax regulations.

In this blog post, we will explore the game-changing impact of AI-powered tax automation and how Tax Pro 360 seamlessly integrates to revolutionize the tax preparation landscape.

The AI Advantage in Tax Automation

1. Automation and Efficiency

AI-powered tax automation has redefined efficiency in tax preparation. Here's how:

Data Entry Simplified: Manual data entry is time-consuming and prone to errors. AI automates data extraction from various sources, reducing human intervention and enhancing accuracy.

Faster Processing: AI processes vast volumes of data at lightning speed. This translates to quicker turnaround times for clients and tax professionals.

2. Enhanced Accuracy

The accuracy of tax calculations and compliance with tax laws are paramount. AI ensures:

Error Reduction: AI-driven systems minimize the risk of human errors in tax calculations and data entry, saving taxpayers from costly mistakes.

Up-to-date Compliance: AI-powered tax software, including Tax Pro 360, stays updated with the latest tax codes, guaranteeing compliance with ever-changing regulations.

3. Predictive Analysis

AI's ability to analyze historical financial data offers tax professionals valuable insights:

Smart Tax Planning: AI predicts potential deductions, credits, and liabilities, enabling tax professionals to offer informed tax planning advice.

Data-Driven Decision Making: Clients benefit from data-driven decisions, making their tax strategies more effective and financially advantageous.

Tax Pro 360: Your All-in-One Tax Solution

1. A Comprehensive Platform

Tax Pro 360 doesn't just offer tax professionals a platform; it offers an entire ecosystem for efficient tax preparation:

Integrated Tools: Tax Pro 360 integrates seamlessly with financial software, providing direct access to client financial data and ensuring data accuracy.

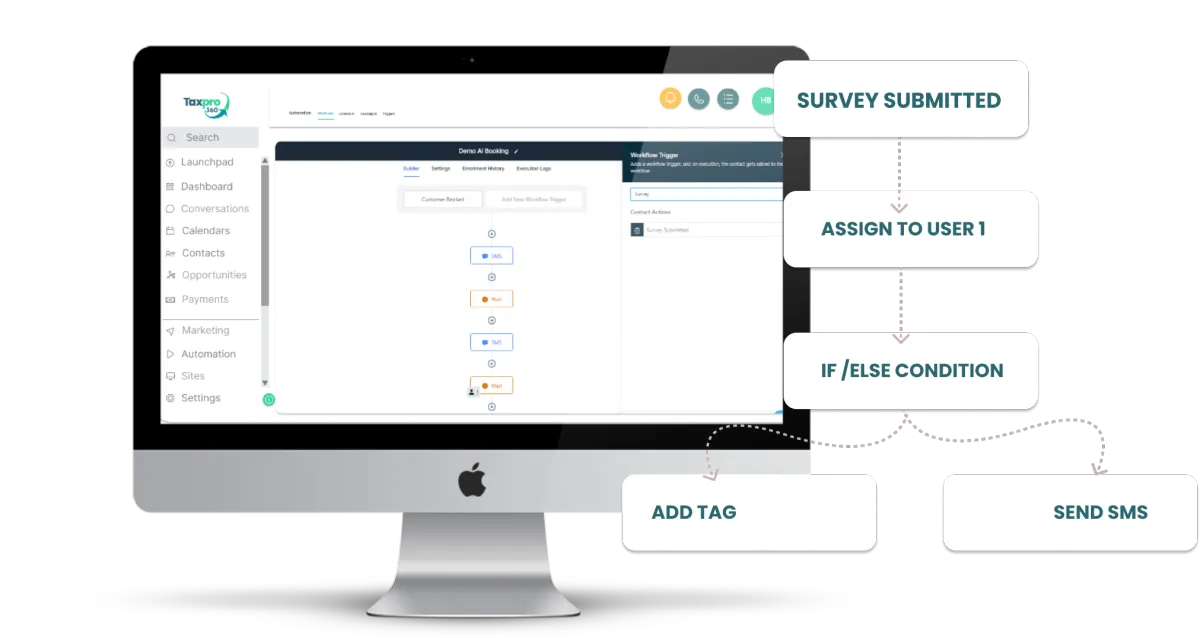

AI-Driven Automation: The platform automates various tasks, from appointment reminders to online review requests, simplifying the tax professional's workload.

2. Client Engagement and Interaction

Tax Pro 360 enhances client relationships

Client Portal: Clients can access a dedicated portal for secure document uploads, real-time communication, and easy access to tax returns.

AI-Powered Chatbots: Instant responses to client inquiries improve client engagement and satisfaction.

3. Streamlined Workflows

Tax Pro 360 streamlines and simplifies tax preparation workflows:

Social Media Planning: The platform includes a social media planner, enabling tax professionals to manage their online presence efficiently.

Reputation Management: Tax Pro 360 assists in managing online reputation by soliciting and responding to Google and Facebook reviews.

The Synergy of AI and Tax Pro 360

When AI-powered tax automation and Tax Pro 360 converge, the results are transformative:

Efficiency Amplified: The combined power of AI and Tax Pro 360 enables tax professionals to serve more clients effectively.

Accuracy Elevated: Enhanced accuracy and automated compliance checks ensure tax returns are error-free and fully compliant.

Client-Centric Approach: AI-driven chatbots and the client portal in Tax Pro 360 enhance client engagement and satisfaction.

Data-Driven Insights: AI's predictive analysis offers tax professionals valuable data-driven insights for effective tax planning and decision-making.

Time and Cost Savings: Automation and AI reduce the time and costs associated with tax preparation.

24/7 Availability: AI-driven solutions, including Tax Pro 360, are available around the clock, providing flexibility for tax professionals and clients.

Conclusion

AI-powered tax automation integrated with Tax Pro 360 is not just the future; it's the present of tax preparation. Combining cutting-edge technology and a comprehensive platform empowers tax professionals to provide efficient, accurate, and client-centric services.

As tax professionals embrace this transformative synergy, they position themselves at the forefront of an industry evolving rapidly, ready to meet the demands of a digital world with confidence and efficiency.

Tax Software Crosslink

Tax Software TaxWise

Tax Software TaxSlayer

Technical Support

Software Installation

Money Flow Info

Tax Related Links

New Hire Links

Page Management

Page Management

© 2023 CrossLink TaxProAlliance. Terms of Use –Privacy Policy